Lesson 1: Reactive Smart Contracts

Overview

In the introduction article, we discuss the basics of Reactive Smart Contracts (RSCs), what they are, and why we need them. Let's dive deeper into the technical concepts of RSCs with some examples to illustrate those concepts.

By the end of this lesson, you will learn to:

- Understand the key differences between Reactive Smart Contracts (RSCs) and traditional smart contracts.

- Grasp the concept of Inversion of Control and its significance in RSCs.

- Recognize how RSCs autonomously monitor and react to blockchain events.

- Explore various practical use cases where RSCs can be applied, such as data collection from oracles, UniSwap stop orders, DEX arbitrage, and pools rebalancing.

How RSCs Differ from Traditional Smart Contracts

The main distinction between RSCs and traditional smart contracts lies in reactivity. Traditional smart contracts are passive, only executing in response to direct EOA transactions. In contrast, RSCs are reactive, continuously monitoring the blockchains for events of interest and autonomously executing predefined blockchain actions in response.

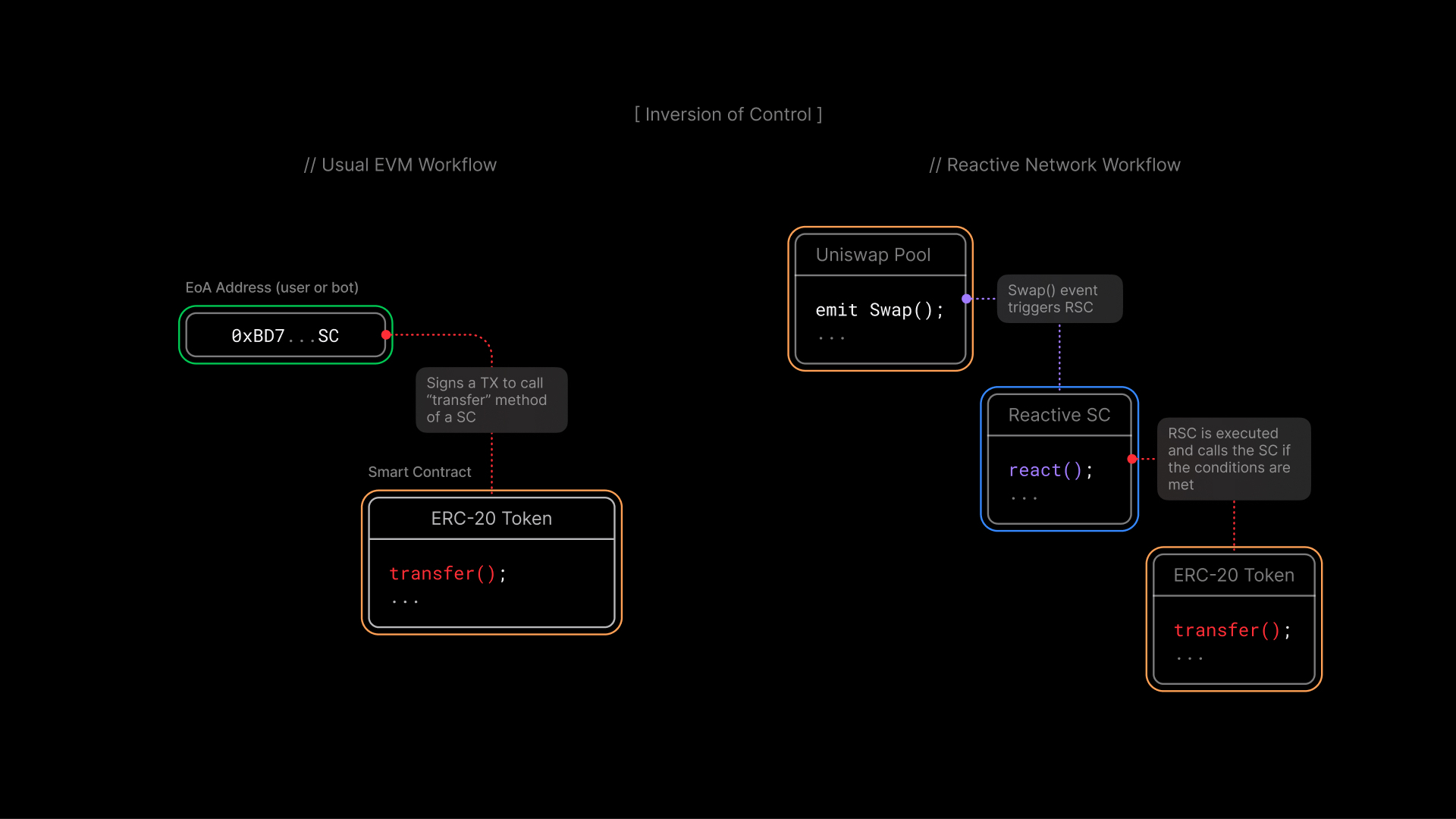

Inversion of Control

A key concept in understanding RSCs is the Inversion of Control (IoC). Traditional smart contracts operate under a direct control model, where the execution of their functions is initiated by external actors (EOA users or bots). RSCs, however, invert this control by autonomously deciding when to execute based on the occurrence of predefined events. This IoC paradigm shifts how applications interact with the blockchain, enabling more dynamic and responsive systems.

Without a reactive contract, you would need to set up a separate entity — let's say a bot — to monitor the blockchains using existing, most likely centralized, data solutions. This bot would hold the private keys for the managed funds and initiate transactions on EVM chains from its EOA address. Though such systems prove to be useful, they might be suboptimal for some use cases and not suitable at all for others.

Inversion of Control allows us to avoid hosting additional entities that emulate humans signing transactions. If you have a predefined scenario outlining the sequence of transactions following on-chain events, you should be able to run this logic in a completely decentralized manner, as both your inputs and outputs remain on the blockchain. The Reactive Network gives smart contracts the property they’ve been missing from the start — the ability to be executed automatically, without a person (or a bot) signing a transaction, just based on other on-chain events.

What Happens Inside a Reactive Smart Contract

When creating a Reactive Smart Contract, the first thing you need to specify is the chains, contracts, and events (topic 0) of interest. The RSC will monitor these addresses for the specified events and initiate execution when one is detected. These events can include simple currency or token transfers, DEX swaps, loans, flash loans, votes, whale moves, or any other smart contract activity.

Once an event of interest is detected, the Reactive Network automatically executes the logic you’ve implemented in your reactive contract. This may involve performing calculations based on the event data. RSCs are stateful, meaning they have a state where values can be stored and updated. You can accumulate data over time in the state and then act when the combination of historical data and a new blockchain event meets the specified criteria.

As a result of the event, the RSC updates its state, keeping it up to date, and can initiate transactions on EVM blockchains. The entire process runs trustlessly within the Reactive Network, ensuring automatic, fast, and reliable execution.

Use Cases

Let's take a closer look at several use cases to illustrate the concepts we’ve just discussed. This educational course will be structured around those use cases because we see practical application as the best way to learn about this tech.

Collecting Data from Several Oracles

For RSCs to respond to a broader spectrum of events, including off-chain occurrences, they integrate with oracles. Oracles are third-party services that feed trusted external data into the blockchain. A simple example of such data includes exchange rates or sports event outcomes. RSCs can use this data to make informed decisions and execute actions based on real-world events, extending their applicability beyond the blockchain.

Moreover, since an RSC can monitor data from different smart contracts across various EVM-compatible blockchains, it can combine data from multiple oracles, resulting in more precise and decentralized information. In this case, the events that RSCs will monitor are the updated events from the corresponding oracles. The calculations within the RSC will involve combining data from different oracles (for example, by taking the average). The resulting action might be a trustless payout based on the outcome of a basketball game.

Uniswap Stop Order

Another example of a reliable data source on the blockchain is a trading pool, such as a Uniswap pool. It can be even more dependable than oracles since it consists of pure on-chain data and does not rely on third parties.

In this setup, a reactive contract would monitor the swaps in the specified UniSwap pool, calculating the liquidity and the exchange rate. When the exchange rate reaches a predetermined price, the reactive contract executes a swap transaction, thereby implementing a trustless stop order on top of the existing DEX.

DEX Arbitrage

However, we can take the previous example further by implementing an actual arbitrage using RSCs. Our reactive contract will monitor several different pools for price discrepancies and capitalize on them. Both one-chain and cross-chain approaches are possible. In the first case, we can use flash loans; in the second case, we will need liquidity on several chains, but we will gain access to more arbitrage opportunities.

The beauty of this solution is that it will be decentralized, unlike the traditional approach with bots. This allows for numerous improvements that we have yet to explore — hopefully, together with you.

Pools Rebalancing

While all the previous use cases involve building RSCs on top of existing traditional Smart Contracts, the next one requires initially developing a DApp that relies on RSCs. If we design our system from the start, knowing that we can leverage the Reactive Network technology, we can build our Ethereum Smart Contracts utilizing the functionality of RSCs.

This approach allows us to potentially create liquidity pools that automatically rebalance across several exchanges. The RSC will monitor liquidity on all chains of interest and rebalance them by adding or draining funds as needed.

Conclusion

After reading this lesson, you should have a solid understanding of the foundational concepts and potential applications of Reactive Smart Contracts (RSCs). Key takeaways include:

-

Reactive vs. Traditional Smart Contracts: Unlike traditional smart contracts, RSCs autonomously monitor blockchain events and execute actions without user intervention, providing a more dynamic and responsive system.

-

Inversion of Control: RSCs invert the traditional execution model by allowing the contract itself to decide when to execute based on predefined events, eliminating the need for external triggers like bots or users.

-

Decentralized Automation: RSCs enable fully decentralized operations, automating processes like data collection, DEX trading, and liquidity management without centralized intermediaries.

-

Cross-Chain Interactions: RSCs can interact with multiple blockchains and sources, enabling sophisticated use cases like cross-chain arbitrage and multi-oracle data aggregation.

-

Practical Applications: RSCs have diverse applications, including collecting data from oracles, implementing UniSwap stop orders, executing DEX arbitrage, and automatically rebalancing pools across exchanges.

Explore more practical applications in our use cases and join our Telegram group to contribute to the evolving world of Reactive Smart Contracts.